Homeowners Insurance in and around Greenwood Village

Looking for homeowners insurance in Greenwood Village?

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

- Highlands Ranch, CO

- Englewood, CO

- Lone Tree, CO

- Denver, CO

- Aurora, CO

- Cherry Hills Village

Home Sweet Home Starts With State Farm

Stepping into homeownership is a big deal. You need to consider cosmetic fixes location and more. But once you find the perfect place to call home, you also need terrific insurance. Finding the right coverage can help your Greenwood Village home be a sweet place to be.

Looking for homeowners insurance in Greenwood Village?

Apply for homeowners insurance with State Farm

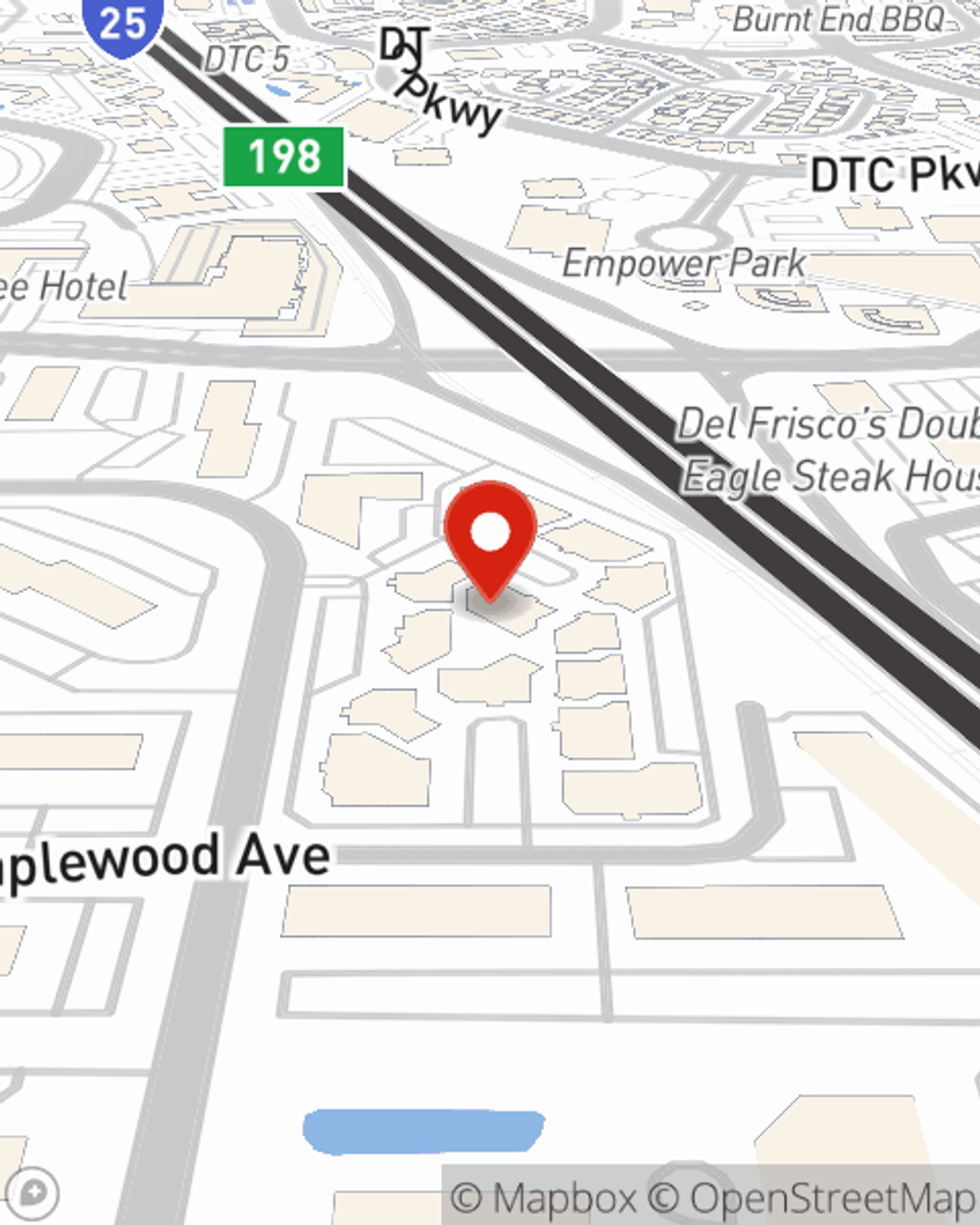

Agent April Welch, At Your Service

Agent April Welch has got you, your home, and your memorabilia shielded with State Farm's homeowners insurance. You can call or go online today to get a move on building a policy that fits your needs.

Don't let your homeowners insurance go over your head, especially when the unexpected occurs. State Farm can bear the load of helping you figure out what works for your home insurance needs. And if that's not enough, bundle and save could be the crown molding to your coverage options. Contact April Welch today for more information!

Have More Questions About Homeowners Insurance?

Call April at (303) 770-3069 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Protecting your home while on vacation

Protecting your home while on vacation

Home security while on vacation is important. Consider these tips before you head out.

April Welch

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Protecting your home while on vacation

Protecting your home while on vacation

Home security while on vacation is important. Consider these tips before you head out.